UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrantþ

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

MORGAN STANLEY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

|

April 12, 20105, 2012

Fellow shareholder:

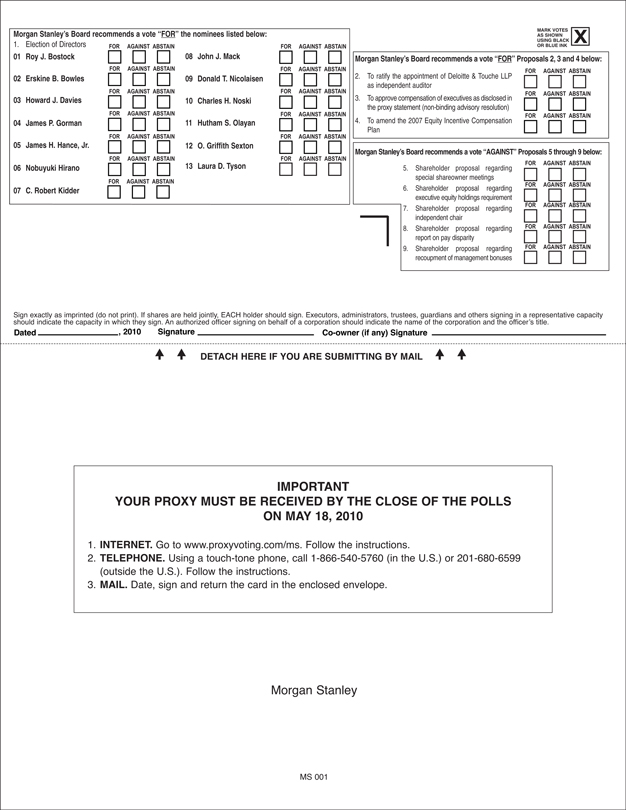

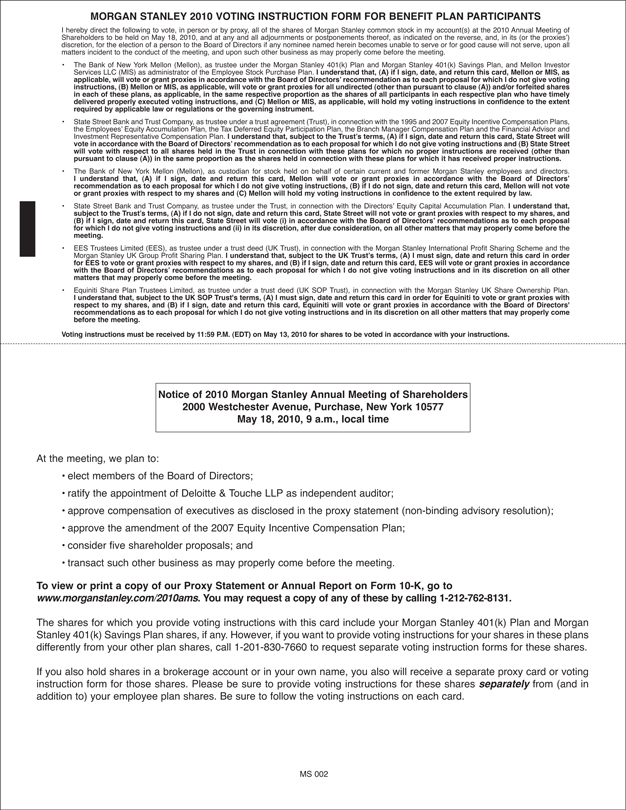

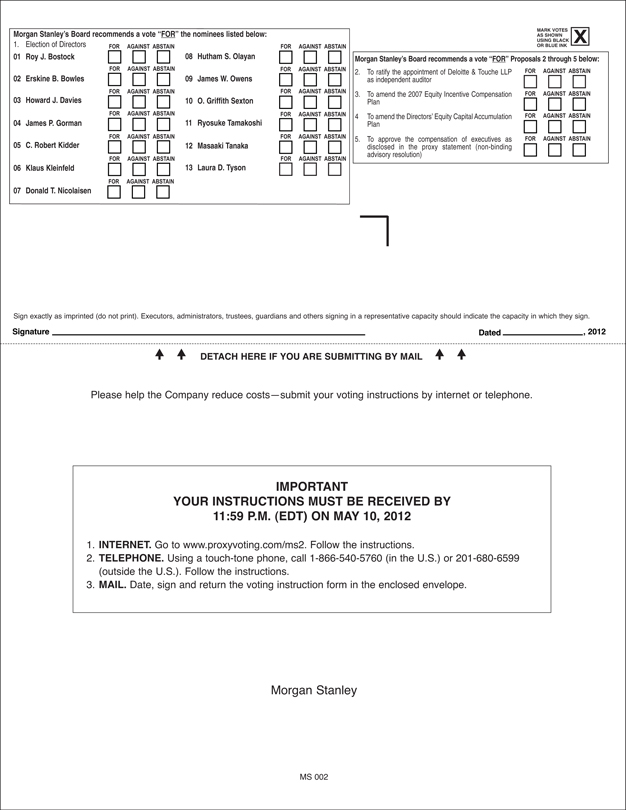

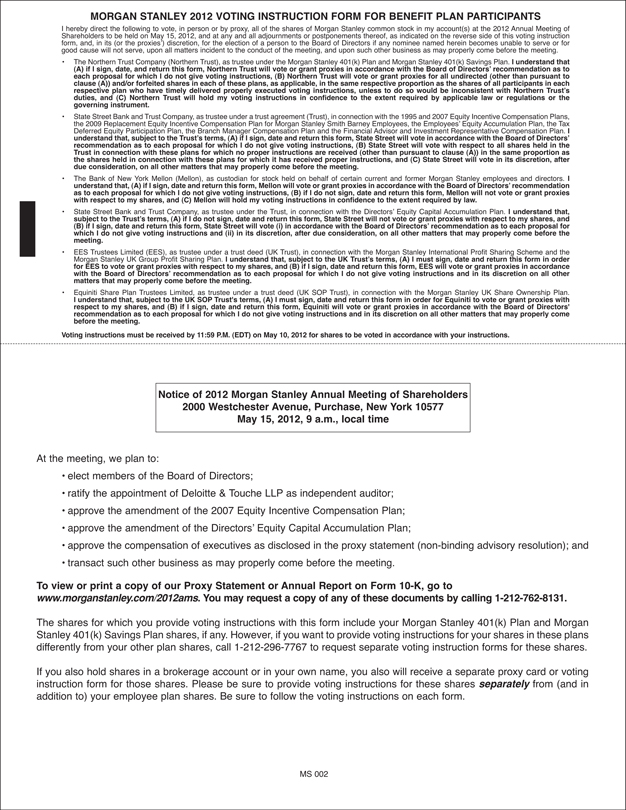

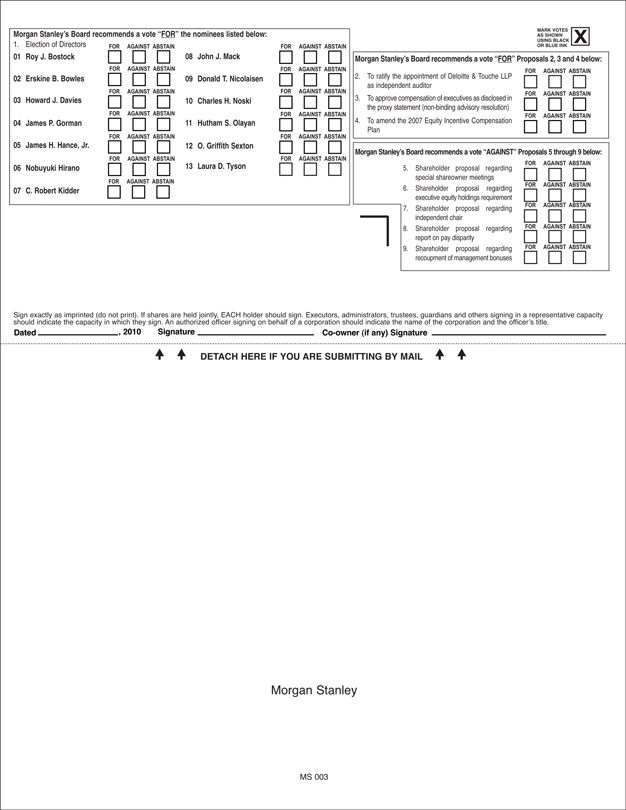

I cordially invite you to attend Morgan Stanley’s 20102012 annual meeting of shareholders to:

elect members of the Board of Directors;

ratify the appointment of Deloitte & Touche LLP as independent auditor;

consider a non-binding advisory votethat will be held on Tuesday, May 15, 2012 at our offices at 2000 Westchester Avenue, Purchase, New York. I hope that you will be able to approve executive compensation;attend.

approve the amendment of the 2007 Equity Incentive Compensation Plan;

consider five shareholder proposals; and

transact such other business as may properly come before the meeting.

Our BoardAt the annual meeting of Directors recommends that you vote“FOR”shareholders, we will consider the electionitems of directors, the ratification of the appointment of the auditor, the approval of the compensation of executives as disclosedbusiness discussed in thisour proxy statement and review significant strategic and other developments in the amendment oflast year.Your vote is very important. Whether or not you plan to attend the 2007 Equity Incentive Compensation Plan, and“AGAINST” the shareholder proposals.meeting, please vote promptly to ensure that your shares are represented.

We enclose our letter to shareholders, our proxy statement, our annual report on Form 10-K and a proxy card. Please submit your proxy. Thank you for your support of Morgan Stanley.

Very truly yours,

|

| James P. Gorman |

| Chairman and Chief Executive Officer |

1585 Broadway

New York, NY 10036

Notice of 2012 Annual Meeting of Shareholders

We are mailing this proxy statement and the accompanying proxy card to shareholders on or about April 6, 2012 in connection with the solicitation of proxies by our Board of Directors for the 2012 annual meeting of shareholders.

In this proxy statement, we refer to Morgan Stanley as the “Company,” “we,” “our” or “us” and the Board of Directors as the “Board.”

About Our Annual Meeting

| Time and Date | 9:00 a.m. (Eastern time) on May 15, 2012 | |

|  | |

|

2000 Westchester Avenue, Purchase, New York | |

• Elect the Board of Directors • Ratify the appointment of Deloitte & Touche LLP as independent auditor • Approve the amendment of the 2007 Equity Incentive Compensation Plan • Approve the amendment of the Directors’ Equity Capital Accumulation Plan • Approve the compensation of executives as disclosed in the proxy statement (non-binding advisory resolution) • Transact such other business as may properly come before the meeting or any postponement or adjournment thereof | ||

| March 19, 2012 | ||

| Admission | Only record or beneficial owners of Morgan Stanley’s common stock or their proxies may attend the annual meeting in person. All shareholders must present photo identification, such as a driver’s license, and | |

| Webcast | If you are unable to attend the meeting in person, you may listen to the meeting atwww.morganstanley.com/about/ir/index.html. Please go to our website prior to the annual meeting for details. | |

| Voting | It is important that you vote all of your shares. You may vote over the Internet or by telephone. You may also submit a proxy card or voting instruction form if you receive one in the mail. | |

| Notice | We are mailing certain shareholders a Notice of Internet Availability of Proxy Materials (“Notice”) on or about April 5, 2012. The Notice informs those shareholders how to access this proxy statement and our Annual Report for the year ended December 31, 2011 through the Internet and how to vote online. | |

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on May 15, 2012: Our Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2011 are available free of charge on our website at www.morganstanley.com/2012ams.

| By Order of the Board of Directors, |

|

| Martin M. Cohen |

| Corporate Secretary |

| April 5, 2012 |

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 12 | ||||

| 12 | ||||

| 14 | ||||

| 16 | ||||

| 18 | |||

| 19 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 20 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 26 | ||||

Compensation, Management Development and Succession Committee Report | 39 | |||

| 39 | ||||

| 42 | ||||

| 45 | |||

| 47 | ||||

| 47 | ||||

| 49 | ||||

| 53 | ||||

| 56 | |||

| 59 | ||||

| 67 | |||

| 70 | ||||

Morgan Stanley

1585 Broadway

New York, New York 10036

April 12, 20105, 2012

Proxy Statement

We are sending you this proxy statement in connection with the solicitation of proxies by our Board of Directors for the 20102012 annual meeting of shareholders. We are mailing this proxy statement and the accompanying form of proxy to shareholders on or about April 13, 2010.6, 2012. In this proxy statement, we refer to Morgan Stanley as the “Company,” “we,” “our” or “us” and the Board of Directors as the “Board.” In December 2008, the Board approved a change in the Company’s fiscal year end from November 30 to December 31, beginning January 1, 2009. The period from December 1, 2008 to December 31, 2008 was a transition period (the December 2008 transition period). Whenever we refer to Morgan Stanley’s fiscal year prior to 2009, we mean the twelve-month period ending November 30 of the stated year. When we refer to 2009, 2010, or 2011, we mean the twelve-month period ending December 31 2009.of the stated year.

Date and Location. We will hold the annual meeting on Tuesday, May 18, 2010 at 9:00 a.m., local time, at our offices at 2000 Westchester Avenue, Purchase, New York.

Admission. Only record or beneficial owners of Morgan Stanley’s common stock or their proxies may attend the annual meeting in person. When you arrive at the annual meeting, you must present photo identification, such as a driver’s license. Beneficial owners must also provide evidence of stock holdings, such as a recent brokerage account or bank statement.

Electronic Access. You may listen to the meeting at www.morganstanley.com/about/ir/index.html. Please go to our website prior to the annual meeting to register.

Record Date. The record date for the annual meeting is March 22, 2010. You may vote all shares of Morgan Stanley’s common stock that you owned as of the close of business on that date. Each share of common stock entitles you to one vote on each matter voted on at the annual meeting. On the record date, 1,398,833,922 shares of common stock were outstanding. We need a majority of the shares of common stock outstanding on the record date represented, in person or by proxy, to hold the annual meeting.

Confidential Voting. Our Amended and Restated Bylaws (Bylaws) provide that your vote is confidential and will not be disclosed to any officer, director or employee, except in certain limited circumstances such as when you request or consent to disclosure. Voting of the shares held in the Morgan Stanley 401(k) Plan and Morgan Stanley 401(k) Savings Plan (401(k) Plans) also is confidential.

Submitting Voting Instructions for Shares Held Through a Broker. If you hold shares through a broker, follow the voting instructions you receive from your broker. If you want to vote in person at the annual meeting, you must obtain a legal proxy from your broker and present it at the annual meeting. If you do not submit voting instructions to your broker, your broker may still be permitted to vote your shares. New York Stock Exchange (NYSE) member brokers may vote your shares as described below.

|

1

|

|

If you do not submit voting instructions and your broker does not have discretion to vote your shares on a matter, the broker will return the proxy card without voting (referred to as “broker non-votes”). Your shares will not be counted in determining the vote on that matter, but will be counted for purposes of determining the presence of a quorum.

Important Notice Regarding Director Elections. Due to recent rule changes, the election of directors is no longer considered a discretionary item and your shares will remain unvoted for director elections if your broker does not receive instructions from you. If you hold your shares through a broker, it is critically important that you submit your voting instructions if you want your shares to count in the election of directors.

Submitting Voting Instructions for Shares Held in Your Name. If you hold shares as a record holder, you may vote by submitting a proxy for your shares by mail, telephone or Internet as described on the proxy card. If you submit your proxy via the Internet, you may incur Internet access charges. Submitting your proxy will not limit your right to vote in person at the annual meeting. A properly completed and submitted proxy will be voted in accordance with your instructions, unless you subsequently revoke your proxy. If you submit a signed proxy card without indicating your voting instructions, the person voting the proxy will vote your shares according to the Board’s recommendations.

Submitting Voting Instructions for Shares Held in Employee Plans. If you hold shares in, or have been awarded stock units under, certain employee plans, you will receive directions on how to submit your voting instructions. Shares held in the following employee plans also are subject to the following rules.

|

|

Revoking Your Proxy. You can revoke your proxy at any time before your shares are voted by (1) delivering a written revocation notice prior to the annual meeting to Martin M. Cohen, Secretary, Morgan Stanley, 1585 Broadway, New York, New York 10036; (2) submitting a later proxy that we receive no later than the conclusion of voting at the annual meeting; or (3) voting in person at the annual meeting. Attending the annual meeting does not revoke your proxy unless you vote in person at the meeting.

2

Votes Required to Elect Directors. Each director will be elected by a majority of the votes cast with respect to such director. A “majority of the votes cast” means that the number of votes cast “for” a director exceeds the number of votes cast “against” that director. Under Delaware law, if the director is not elected at the annual meeting, the director will continue to serve on the Board as a “holdover director.” As required by the Company’s Bylaws, each director has submitted an irrevocable letter of resignation as director that becomes effective if he or she is not elected by the shareholders and the Board accepts the resignation. If a director is not elected, the Nominating and Governance Committee will consider the director’s resignation and recommend to the Board whether to accept or reject the resignation. The Board will decide whether to accept or reject the resignation and publicly disclose its decision, including the rationale behind the decision if it rejects the resignation, within 90 days after the election results are certified.

Votes Required to Adopt Other Proposals. The ratification of Deloitte & Touche LLP’s appointment as independent auditor, the approval of the compensation of executives as disclosed in this proxy statement and the approval of the shareholder proposals each require the affirmative vote of a majority of the shares of common stock represented at the annual meeting and entitled to vote thereon. The approval of the amendment of the 2007 Equity Incentive Compensation Plan requires a majority of votes cast, provided that the total votes cast must represent a majority of the shares entitled to vote on the proposal.

“Abstaining” and “Broker Non-Votes.” You may vote “abstain” for any nominee in the election of directors and on the other proposals. Shares voting “abstain” on any nominee for director will be excluded entirely from the vote and will have no effect on the election of directors. Shares voting “abstain” on the other proposals will be counted as present at the annual meeting for purposes of establishing the presence of a quorum and your abstention will have the effect of a vote against the proposal. In addition, failure to cast a vote or a broker non-vote can have the effect of a vote against the proposal to approve the amendment of the 2007 Equity Incentive Compensation Plan if such failure or broker non-vote results in the total number of votes cast on the proposal not representing over 50% of all shares of common stock entitled to vote on the proposal.

Director Selection and Nomination Process. Process

Our Board currently has 13 directors. The Nominating and Governance Committee’s charter provides that the Committee is appointed by the Board of Directors to identify individuals qualified to become Board members and to recommend to the Board the director nominees at annual meetings of shareholders. In discharging its duties, the Nominating and Governance Committee’s charter provides that the Committeecommittee will actively seek and identify nominees for recommendation to the Board consistent with the Board membership criteria set forth in the Corporate Governance Policies. The Corporate Governance Policies, which provide that the Board values members who combinewho:

Combine a broad spectrum of experience and expertise with a reputation for integrity and that directors should haveintegrity;

Have experience in positions with a high degree of responsibility, beresponsibility;

Are leaders in the companies or institutions with which they are affiliated and be selected based uponaffiliated;

Can make contributions they can make to the Board and managementmanagement; and their ability to represent

Represent the interests of shareholders.

While the Board has not adopted a policy regarding diversity, the Morgan Stanley Corporate Governance Policies (Corporate Governance Policies) provide that the Board will take into account diversity of a director candidate’s perspectives, background and other relevant demographics. The Nominating and Governance Committee and Board may also determine specific skills and experience they are seeking in director candidates based on the needs of the Company at a specific time. In considering candidates for the Board, the Nominating and Governance Committee considers the entirety of each candidate’s credentials in the context of these criteria.

As set forth in its charter, theThe Nominating and Governance Committee may consider, director candidates proposed by shareholders and the Board has adopted a policy regarding, director candidates recommendedproposed by shareholders discussed under “Shareholder Nominations for Director Candidates” herein.(see “Corporate Governance Policies”). The Nominating and Governance Committee may also retain and terminate, in its sole discretion, a third party to assist in identifying director candidates or to assist in gathering information regarding a director candidate’s background and experience and to approve the fee that the Company pays for these services.experience. Members of the Nominating and Governance

3

Committee, the Lead Director and other members of the Board interview potential director candidates as part of the selection process when evaluating new director candidates.

Pursuant to the terms of the Investor Agreement between Morgan Stanley and Mitsubishi UFJ Financial Group, Inc. (MUFG) dated October 13, 2008, as amended and restated as of June 30, 2011 (Investor Agreement), Morgan Stanley agreed to take all lawful action to cause two of MUFG’s senior officers or directors to become members of Morgan Stanley’s Board. In March 2011, MUFG designated Mr. Masaaki Tanaka as a representative director under the Investor Agreement, and Mr. Tanaka was elected by shareholders at the 2011 annual meeting of shareholders. MUFG designated Mr. Ryosuke Tamakoshi as its second representative director under the Investor Agreement, and Mr. Tamakoshi was elected by the Board on July 20, 2011.

1

Director Experience, Qualifications, Attributes and Skills

When the Board nominates directors for election at an annual meeting, it evaluates the experience, qualifications, attributes and skills that an individual director candidate contributes to the Board as a whole to assist the Board in discharging its duties. As part of the ongoing process to evaluate these attributes, the Board performs an annual self-evaluation and has adopted a Corporate Governance Policy that provides that the Board expects a director whose principal occupation or employer changes, or who changesexperiences other changed circumstances that could diminish his or her present job responsibilityeffectiveness as a director or otherwise be detrimental to the Company, to advise and to offer to tender his or her resignation for consideration by the Board.

The Company believes that an effective board consists of a diverse group of individuals who bring a variety of complementary skills. The Nominating and Governance Committee and Board consider these skills in the broader context of the Board’s overall composition, with a view toward constituting a board that has the best skill set and experience to oversee the Company’s business. Our directors have a combined wealth of leadership experience derived from extensive service guiding large, complex organizations as executive leaders or board members and in government and academia and possess substantive knowledge and skills applicable to our business, including experience in the following areas:

Regulatory Public Accounting and Financial Reporting Finance Risk Management Business Development | Operations Strategic Planning Management Development and Succession Compensation Corporate Governance | Public Policy International Matters Banking Financial Services |

The Nominating and Governance Committee regularly reviews the composition of the Board currentlyin light of the Company’s evolving business requirements and its assessment of the Board’s performance to ensure that the Board has fourteen (14) directors. the appropriate mix of skills needed for the broad set of challenges that it confronts.

The Board stands for election at each annual meeting of shareholders. Each director holds office until his or her successor has been duly elected and qualified or the director’s earlier resignation, death or removal.

In connection with its 2008 issuance of Series B Non-Cumulative Non-Voting Perpetual Convertible Preferred Stock (Series B Preferred Stock) to Mitsubishi UFJ Financial Group, Inc. (MUFG), Morgan Stanley entered into an Investor Agreement with MUFG dated October 13, 2008 and amended as of October 27, 2008 (Investor Agreement), whereby Morgan Stanley agreed to take all lawful action to cause one of MUFG’s senior officers or directors to be a member of Morgan Stanley’s Board of Directors. Pursuant to the terms of the Investor Agreement, Mr. Nobuyuki Hirano was elected to the Board, effective March 10, 2009. Mr. Hirano subsequently was elected by shareholders at the 2009 annual meeting of shareholders.

In light of the Company’s conversion into a financial holding company, an executive officer of the Company recommended Mr. James H. Hance, Jr. as a potential director candidate to the Nominating and Governance Committee and to the committee’s third party director search firm given his extensive financial services background as described below. The Lead Director and other directors met or spoke with Mr. Hance. The Committee unanimously recommended to the Board that Mr. Hance be elected as a director, and the Board unanimously elected Mr. Hance, effective July 1, 2009. Mr. Charles E. Phillips, Jr. will not stand for re-election at this annual meeting of shareholders.

2010 Director Nominees. The Board has nominated the thirteen (13)13 director nominees below for election at the 20102012 annual meeting of shareholders in accordance with the Corporate Governance Policies. Each nominee has indicated that he or she will serve if elected. We do not anticipate that any nominee will be unable or unwilling to stand for election, but if that happens, your proxy will be voted for another person nominated by the Board. On March 30, 2012, James H. Hance, Jr. notified the Company that he will not stand for re-election at the annual meeting of shareholders.

Below are descriptionsThe Nominating and Governance Committee’s third-party search firm and members of the experience, qualifications, attributes and skills of each of the Company’sBoard recommended Mr. Klaus Kleinfeld as a potential director nominees. The Company believes that an effective board consists of a diverse group of individuals who bring a variety of complementary skills thatcandidate to the Nominating and Governance Committee andCommittee. The Board consider inunanimously nominated Mr. Kleinfeld for election at the broader contextannual meeting of the Board’s overall composition, with a view toward constituting a board that has the best skill set and experience to oversee the Company’s business. As indicated below, our directors have a combined wealth of leadership experience derived from extensive service guiding large, complex organizations as executive leaders or board members and in government and academia. They have substantive knowledge and skills applicable to our business, including in the regulatory; public accounting and financial reporting; finance; risk management; business development; operations; strategic planning; management development, succession and compensation; corporate governance; public policy; international; banking; and financial services areas. The Nominating and Governance Committee regularly reviews the composition of the Board in light of Morgan Stanley’s evolving business requirements and its assessment of the Board’s performance to ensure that the Board has the appropriate mix of skills needed for the broad set of challenges that it confronts.shareholders.

2

4

| Roy J. Bostock Director Since 2005 | Professional Experience: • Mr. Bostock has served as non-executive Vice Chairman of the Board of Delta Air Lines, Inc. since 2009 and Chairman of the Board of Yahoo! Inc. since 2008. • He has served as a principal of Sealedge Investments, LLC, a diversified private investment company, since 2002. • Mr. Bostock is Chairman Emeritus, and served as Chairman from 2002 to 2010, of the Partnership for a Drug-Free America • He worked in the advertising agency business for 38 years beginning in 1964. • Mr. Bostock was Chairman of B|Com3 Group, Inc., • He also served as Chairman and Chief Executive Officer of D’Arcy, Masius Benton & Bowles

Other

Other Directorships in the Past Five Years: Northwest Airlines Corporation (prior to its merger with Delta Air Lines, Inc.) Qualifications, Attributes and Skills:Mr. Bostock’s varied leadership positions, including as chief executive officer of advertising and marketing services firms and in connection with non-profit organizations and public company boards, brings to the Board the perspective of an experienced leader with strategic planning, operations and business development skills. |

| Erskine B. Bowles Director Since 2005 | Professional Experience: • Mr. Bowles has • He served as Co-Chair of the National Commission on Fiscal Responsibility and • Mr. Bowles has been a senior advisor at BDT Capital Partners LLC, a private investment firm, since 2012. He has been a senior advisor since 2001 and was Managing Director from 1999 to 2001 of Carousel Capital LLC, a private investment firm. He was also a partner at the private investment firm of Forstmann Little & Co. from 1999 to • He began his career in corporate finance at Morgan Stanley in 1969 and subsequently helped found and • Mr. Bowles served as White House Chief of Staff from 1996 to 1998 and Deputy White House Chief of Staff from 1994 to 1995. He was head of the Small Business Administration from 1993 to

Other

Qualifications, Attributes and Skills: Mr. Bowles brings to the Board his extensive experience in the financial services industry and academia as well as distinguished public service. | ||

53

| ||

Howard J. Davies Director Since 2004 | Professional Experience: • Mr. Davies has served as a professor at SciencesPo, the Paris School of International Affairs since 2011. • He is an external advisor to the Government Investment Corporation of Singapore and a member of the International Advisory Board of the China Securities Regulatory Commission. • Mr. Davies served as Director of the London School of Economics and Political Science • Mr. Davies previously served as Deputy Governor of the Bank of England from 1995 to 1997. He was Director General of the Confederation of British Industry from 1992 to 1995 and Controller of the Audit Commission in the U.K. from 1987 to 1992. • He worked at McKinsey & Co. from 1982 to 1987 and was seconded to the Treasurer as Special Advisor to the Chancellor of the Exchequer. Other Current Directorships: Prudential plc

Mr. Davies brings an international perspective to the Board as well as extensive financial regulatory, accounting and risk management experience from his years of accomplished public service. | |

James P. Gorman (53) Director Since 2010 |

• Mr. Gorman has served as Chairman of the Board since 2012, President and Chief Executive Officer of Morgan Stanley since 2010, and • He was Co-President of Morgan Stanley from 2007 to 2009, Co-Head of Strategic Planning from 2007 to 2009 and President and Chief Operating Officer of the Global Wealth Management Group from 2006 to 2008. • Mr. Gorman joined Merrill Lynch & Co., Inc. in 1999 and served in various positions including Chief Marketing Officer, Head of Corporate Acquisitions Strategy and Research in 2005 and President of the Global Private Client business from 2002 to 2005. • Prior to joining Merrill Lynch, he was a senior partner at McKinsey & Co., serving in the firm’s financial services practice. Earlier in his career, Mr. Gorman was an attorney in Australia.

Other

Qualifications, Attributes and Skills:As Chief Executive Officer of the Company, Mr. Gorman is a proven leader with an established record as a strategic thinker backed by strong operating, business development and execution skills and brings an extensive understanding of Morgan Stanley’s businesses and decades of financial services experience. | |

64

|

| |

|

| |

7

| C. Robert Kidder Director Since 1993 | Professional Experience: • Mr. Kidder • He was Principal at Stonehenge Partners, Inc., a private investment firm, from 2004 to 2006. Mr. Kidder served as President of Borden Capital, Inc., a company that provided financial and strategic advice to the Borden family of companies, from 2001 to 2003. • He was Chairman of the Board from 1995 to 2004 and Chief Executive Officer from 1995 to 2002 of Borden Chemical, Inc. (formerly Borden, Inc.), a forest products and industrial chemicals company. • Mr. Kidder was Chairman and Chief Executive Officer from 1991 to 1994 and President and Chief Executive Officer from 1988 to 1991 of Duracell International Inc. Prior to joining Duracell International Inc. in 1980, Mr. Kidder worked in planning and development at Dart Industries. He also previously worked at McKinsey & Co. as a general management consultant.

Other

Mr. Kidder brings to the Board extensive financial and senior executive experience, including in business development, operations and strategic planning, as well as a deep understanding of our Company, particularly in his capacity as Lead Director appointed by our independent directors. | ||

Klaus Kleinfeld (54) Director Nominee |

• Mr. • He served as President and CEO from 2008 to 2010 and President and Chief Operating Officer from 2007 through 2008 of Alcoa. • Mr. Kleinfeld served for 20 years at Siemens AG from 1987 to 2007, including as CEO and President from 2005 to 2007, a member of the Managing Board • He serves on the Brookings Institution Board of Trustees and Other Current Directorships: Alcoa, Inc. and

| |||

85

| Donald T. Nicolaisen Director Since 2006 | Professional Experience: • Mr. Nicolaisen was Chief Accountant for the U.S. Securities and Exchange Commission (SEC) from 2003 to 2005, where he served as the principal advisor to the SEC on accounting and auditing matters and was responsible for formulating and administering the accounting program and policies of the SEC. • He was a partner of PricewaterhouseCoopers, an accounting firm, from 1978 to 2003 and first joined Price Waterhouse in 1967. • Mr. Nicolaisen led Price Waterhouse’s national office for accounting and SEC services and its financial services practice and was responsible for auditing and providing risk management advice to large, complex multi-national corporations.

Other

Qualifications, Attributes and Skills: Mr. Nicolaisen brings to the Board over 40 years of regulatory, public accounting and financial reporting, risk management and financial experience and the varied perspectives he has gained in the private sector as well as through distinguished service at the SEC. | ||

|

| |||

9

| Hutham S. Olayan Director Since 2006 | Professional Experience: • Ms. Olayan has been a principal and director since 1981 of The Olayan Group, a private multinational enterprise that is a diversified global investor and operator of commercial and industrial businesses in Saudi Arabia. • Ms. Olayan has been President and Chief Executive Officer of The Olayan Group’s U.S. operations for more than 20 years, overseeing all investment activity • Ms. Olayan is a member of the International Advisory Board of The Blackstone Group and a former director of Equity International and

Ms. Olayan’s extensive financial experience in the U.S. and internationally, including the Middle East, strengthens the Board’s global perspective. |

6

James W. Owens (66) Director Since 2011 | Professional Experience: • Mr. Owens served as Chairman and Chief Executive Officer of Caterpillar Inc., a manufacturer of construction and mining equipment, diesel and natural gas engines and industrial gas turbines, from 2004 to 2010. • He served as Vice Chairman of Caterpillar Inc. from 2003 to 2004 and as Group President from 1995 to 2003, responsible at various times for 13 of the company’s 25 divisions. • Mr. Owens served at Caterpillar Inc. as Vice President and Chief Financial Officer from 1993 to 1995, Corporate Vice President and President of Solar Turbines Incorporated from 1990 to 1993, and managing director of P.T. Natra Raya, Caterpillar Inc.’s Indonesian joint venture, from 1987 to 1990. • He held various managerial positions in the Accounting and Product Source Planning Departments from 1980 to 1987 and was chief economist of Caterpillar Overseas S.A. in Geneva, Switzerland from 1975 to 1980. Mr. Owens joined Caterpillar Inc. in 1972 as a corporate economist. • He served on the President’s Economic Recovery Advisory Board from 2009 to 2011. Mr. Owens serves on the boards of the Peter G. Peterson Institute for International Economics and the Council on Foreign Relations and is a senior advisor at Kohlberg Kravis Roberts & Co. Other Current Directorships: Alcoa Inc. and International Business Machines Corporation Other Directorships in the Past Five Years: Caterpillar Inc. Qualifications, Attributes and Skills: Mr. Owens’ various leadership positions, including as Chief Executive Officer of a major global corporation, bring to the Board extensive management experience and economics expertise and strengthens the Board’s global perspective. | |

O. Griffith Sexton (68) Director Since 2005 |

• Mr. Sexton has served as an adjunct professor at Columbia Business School since 1995 and visiting lecturer at Princeton University since 2000, teaching courses in corporate finance. • He was an Advisory Director of Morgan Stanley from 1995 to 2008. • Mr. Sexton joined Morgan Stanley in 1973 and was a Managing Director from 1985 to 1995, ultimately serving as Director of the Corporate Restructuring Group within the Advisory Services Department.

Other

Qualifications, Attributes and Skills: Mr. Sexton brings to the Board extensive financial services, accounting and risk experience as well as substantive knowledge of Morgan Stanley’s businesses from his nearly 40 years of prior service at the Company. | |

7

Ryosuke Tamakoshi (64) Director Since 2011 | Professional Experience: • Mr. Tamakoshi has served as a Senior Advisor of The Bank of Tokyo-Mitsubishi UFJ, Ltd. (BTMU) since 2010. • Mr. Tamakoshi served as Chairman of MUFG from 2005 to 2010 and as Deputy Chairman of The Bank of Tokyo-Mitsubishi UFJ, Ltd. from 2006 to 2008. Before the merger between Mitsubishi Tokyo Financial Group and UFJ Holdings, Mr. Tamakoshi was President and Chief Executive Officer of UFJ Holdings, Inc. and also Chairman of UFJ Bank, Ltd. • Mr. Tamakoshi began his professional career at The Sanwa Bank, one of the legacy banks of BTMU, in 1970. Other Directorships in the Past Five Years: Mitsubishi UFJ Financial Group, Inc. Qualifications, Attributes and Skills: As a senior officer advisor to BTMU and as former Chairman of Mitsubishi UFJ Financial Group, Inc., Mr. Tamakoshi brings to the Board over 40 years of banking experience and international, risk management and strategic expertise. | |

Masaaki Tanaka (59) Director Since 2011 | Professional Experience: • Mr. Tanaka has served as Resident Managing Officer for the United States for MUFG since June 2011 and has served as the Senior Managing Executive Officer and Chief Executive Officer for the Americas of BTMU since 2011. • He served as Managing Executive Officer and Chief Executive Officer for the Americas of BTMU from 2010 to 2011. In 2007, he was named a Managing Executive Officer of BTMU. • From 2007 to 2010, Mr. Tanaka was President and Chief Executive Officer of UnionBanCal Corporation and its primary subsidiary, Union Bank, N.A., where he continues to serve as a director. • Following the merger of The Bank of Tokyo-Mitsubishi, Ltd. (BTM) and UFJ Bank, Ltd., which created BTMU, Mr. Tanaka served as Executive Officer and General Manager of the Corporate Planning Division for the newly combined bank from 2006 to 2007. • From 1996 to 2005, Mr. Tanaka served in various capacities in the Corporate Planning Division of BTM and was Executive Officer and General Manager of the Corporate Banking Division with responsibility for relationships with leading corporations. He was also General Manager of the Corporate Business Development Division where he directed strategic planning and coordination of the company’s corporate banking business. • Mr. Tanaka began his professional career at the Mitsubishi Bank, a predecessor to BTMU, in 1977. Other Current Directorships: UnionBanCal Corporation Qualifications, Attributes and Skills: As a senior officer of BTMU and its associated companies, Mr. Tanaka brings to the Board over 35 years of banking experience and international, risk management and strategic expertise. | |

8

Laura D. Tyson Director Since 1997 | Professional Experience: • Dr. Tyson has served as the S. K. and Angela Chan Professor of Global Management since 2008 and served as Professor of Business Administration and Economics from 2007 to 2008 at the Walter A. Haas School of Business, University of California, • She was Dean of the London Business School from 2002 to 2006. • Dr. Tyson was Dean from 1998 to 2001 and Class of 1939 Professor in Economics and Business Administration from 1997 to 1998 at the Walter A. Haas School of Business, University of California, Berkeley. • She served as National Economic Advisor to the President and Chair of the President’s National Economic Council from 1995 to 1996 and as Chair of the White House Council of Economic Advisors from 1993 to 1995. • Dr. Tyson • She also serves on the Peter G. Peterson Institute of International Economics.

Other

Qualifications, Attributes and Skills: Dr. Tyson brings to the Board economics and public policy expertise and leadership skills from her positions in academia and through her distinguished public service. |

Our Board unanimously recommends a vote “FOR” the election of all thirteen (13)director nominees. Proxies solicited by our Board will be voted “FOR” these nominees unless otherwise instructed.

10

Morgan Stanley is committed to maintaining best-in-class governance practices and has implemented the following:

Shareholders who own at least 25% of common stock have the ability to call a special meeting of shareholders;

No supermajority vote requirements in our charter or bylaws;

All directors are elected annually by majority vote standard;

Our Board has a majority of independent directors;

Our Board has financial services experience and a diverse international background;

Lead independent director is appointed, and reviewed annually, by the other independent directors; and

Board policy favors committee chair and lead director rotation.

Corporate Governance Documents.Policies

Morgan Stanley has a corporate governance webpage atmorganstanley.com/about/company/governance that includes the “Company Information” link under the “About Morgan Stanley” link at www.morganstanley.com (www.morganstanley.com/about/company/governance/index.html).following:

Our Corporate Governance Policies (including our Director Independence Standards),

Code of Ethics and Business Conduct

Board Committee charters, Charters

Policy Regarding Communication by Shareholders and Other Interested Parties with the Board of Directors

Shareholders and other interested parties may contact any of our Company’s directors (including the Lead Director or non-management directors) by writing to them at Morgan Stanley, Suite D, 1585 Broadway, New York, New York 10036. Such communications will be handled in accordance with the procedures approved by the Company’s independent directors.

9

Policy Regarding Director Candidates Recommended by Shareholders

Shareholders may submit recommendations for director candidates for consideration by the Nominating and Governance Committee at any time by sending the information set forth in the policy to the Nominating and Governance Committee, Morgan Stanley, Suite D, 1585 Broadway, New York, New York 10036. Under the policy, in order for director candidate recommendations to be considered for the 2013 annual meeting of shareholders, recommendations must be submitted in accordance with the policy by December 7, 2012.

Policy Regarding Corporate Political Contributions

Policy Regarding Shareholder Rights Plan information regarding

Information Regarding the Integrity Hotline and the Equity Ownership Commitment are available at our corporate governance webpage at www.morganstanley.com/about/company/governance/index.html and

Hard copies of these materials are available to any shareholder who requests them by writing to Morgan Stanley, Suite D, 1585 Broadway, New York, New York 10036.

Shareholders and other interested parties may contact any of our Company’s directors, the Lead Director, a committee of the Board, the Board’s non-employee directors as a group or the Board generally, by writing to them at Morgan Stanley, Suite D, 1585 Broadway, New York, New York 10036. Shareholder and interested party communications received in this manner will be handled in accordance with the procedures approved by the Company’s independent directors. The Board’s Policy Regarding Communication by Shareholders and Other Interested Parties with the Board of Directors is available at our corporate governance webpage at www.morganstanley.com/about/company/governance/index.html.

Director Independence.Independence

The Board has determined that Messrs. Bostock, Bowles, Davies, Hance, Kidder, Kleinfeld and Nicolaisen, Noski, Ms. Olayan, Messrs. PhillipsOwens and Sexton, and Dr.Ms. Tyson, and Mr. Hance, who is not standing for re-election, are independent in accordance with the Director Independence Standards established under our Corporate Governance Policies.

To assist the Board with its determination, the standards follow NYSENew York Stock Exchange (NYSE) rules and establish guidelines as to employment and commercial relationships that affect independence and categories of relationships that are not deemed material for purposes of director independence. Eleven (11)Ten of fourteen (14)13 of our current directors are independent. Upon the election of the current slate of director nominees, 10 of our 13 directors will be independent.

10

In making its determination as to the independent directors, the Board reviewed relationships between Morgan Stanley and the directors, including:

| Relationship | Director(s) | |

Commercial relationshipsin the last three years between Morgan Stanley and entities where the directors are employees or executive officers, or their immediate family members are executive officers, that did not exceed the greater of $1 million or 2% of such other entity’s consolidated gross revenues in any of the last three years | Bostock, Davies, Kleinfeld, Olayan and Tyson | |

Ordinary course relationships arising from transactions on terms and conditions substantially similar to those with unaffiliated third parties between Morgan Stanley and entities where the directors or their immediate family members own equity of 5% or more of that entity | Bostock | |

Morgan Stanley’scontributions to charitable organizations where the directors or their immediate family members serve as officers, directors or trustees that did not exceed the greater of $100,000 or 1% of the organization’s consolidated gross revenues in the preceding year | Bostock, Bowles, Davies, Hance, Kidder, Kleinfeld, Olayan and Owens | |

| Directors’utilization of Morgan Stanley products and services in the ordinary course of business on terms and conditions substantially similar to those provided to unaffiliated third parties | Bostock, Hance, Kidder, Owens, Sexton and Tyson |

In determining Mr. Bostock’s independence, the Board also considered the restructuring in January 2012 of the Company’s relationship with FrontPoint Partners LLC (FrontPoint), a former subsidiary within the Company’s Asset Management segment, of which Mr. Bostock’s son-in-law is Co-Chief Executive Officer and a significant equity owner. The Board considered that Mr. Bostock was not involved in any discussions or decisions regarding the restructuring; that the Company has ceased to have an equity interest in FrontPoint; Mr. Bostock’s son-in-law is no longer an employee of the Company as of March 1, 2011; and any future commercial activities with FrontPoint will be in the ordinary course of business and on substantially the same terms as those prevailing at the time for comparable services for unaffiliated third parties. The Board (other than Mr. Bostock) determined consistent with NYSE rules and based upon the facts and circumstances, that the relationship is immaterial to Mr. Bostock’s independence (see also “Certain Transactions” herein).

In determining Mr. Sexton’s independence, the Board (other than Mr. Sexton) considered that the Company provides Mr. Sexton with access to medical insurance, for which Mr. Sexton pays the full cost, and determined, consistent with NYSE rules and based upon the facts and circumstances, that the relationship is immaterial to Mr. Sexton’s independence.

11

Director Attendance at Annual Meeting

The Company’s Corporate Governance Policies state that directors are expected to attend annual meetings of shareholders. All of the current directors who were on the Board at the time attended the 2011 annual meeting of shareholders. One of the 13 directors on the Board of Directors at the time of the 2011 annual meeting of shareholders was not standing for re-election and did not attend the meeting.

Our Board met 15 times during 2011. Each director attended at least 75% of the total number of meetings of the Board and committees on which the director served that were held during 2011 while the director was a member. In addition to Board and committee meetings, our directors also discharge their duties through, among other things, informal group communications and discussions with the Lead Director, Chairman of the Board and Chief Executive Officer, members of senior management and others as appropriate regarding matters of interest.

The Company’s Corporate Governance Policies provide that non-management directors meet in executive sessions and that the Lead Director will preside over these executive sessions. The independent directors also meet in executive session at least once annually and the Lead Director presides over these executive sessions.

The Board’s standing committees, their membership and the number of meetings in 2011 are set forth below. Charters for each of our standing committees are available at our corporate governance webpage.

All members of the Audit Committee, the Compensation, Management Development and Succession Committee and the Nominating and Governance Committee satisfy the standards of independence applicable to members of such committees. All members of the Risk Committee and Operations and Technology Committee are non-employee directors and a majority of the Risk Committee members of such committees satisfy the independence requirements of the Company and the NYSE. In addition, the Board has determined that all members of the Audit Committee Messrs. Davies, Hance, Nicolaisen, Noski and Sexton, are “audit committee financial experts” within the meaning of current SEC rules.

In making its determination as to the independent directors, the Board reviewed relationships between Morgan Stanley and the directors, including commercial relationships in the last three years between Morgan Stanley and entities where the directors are employees or executive officers, or their immediate family members are executive officers, that did not exceed a certain amount of such other entity’s gross revenues in any year (Messrs. Bowles and Davies, Ms. Olayan, Mr. Phillips and Dr. Tyson); ordinary course relationships arising from transactions on terms and conditions substantially similar to those with unaffiliated third parties between Morgan Stanley and entities where the directors or their immediate family members own equity of 5% or more of that entity (Mr. Bostock and Ms. Olayan); Morgan Stanley’s contributions to charitable organizations where the directors or their immediate family members serve as officers, directors or trustees that did not exceed a certain amount of the organization’s annual charitable receipts in the preceding year (Messrs. Bostock, Bowles, Davies and Kidder, Ms. Olayan, Mr. Phillips and Dr. Tyson); and the directors’ utilization of Morgan Stanley products and services in the ordinary course of business on terms and conditions substantially similar to those provided to unaffiliated third parties (Messrs. Bostock, Hance, Kidder, Noski, Phillips and Sexton and Dr. Tyson).12

In determining Mr. Bostock’s independence, the Board also considered the employment of Mr. Bostock’s son-in-law by the Company’s Asset Management segment (see also “Other Matters—Certain Transactions” herein). This year the Board considered, among other things, that Mr. Bostock’s son-in-law has never been a

| Committee | Current Members | Primary Responsibilities | Meetings Held in 2011 | |||||||

Audit | Donald T. Nicolaisen (Chair) Howard J. Davies James H. Hance, Jr. O. Griffith Sexton | • | Oversees the integrity of the Company’s consolidated financial statements, compliance with legal and regulatory requirements and system of internal controls. | 10 | ||||||

| • | Oversees risk management and risk assessment guidelines in coordination with the Board, Risk Committee and Operations and Technology Committee and reviews the major franchise, reputational, legal and compliance risk exposures of the Company. | |||||||||

| • | Selects, determines the compensation of, evaluates and, when appropriate, replaces the independent auditor, and pre-approves audit and permitted non-audit services. | |||||||||

| • | Oversees the qualifications and independence of the independent auditor and performance of the Company’s internal auditor and independent auditor. | |||||||||

| • | After review, recommends to the Board the acceptance and inclusion of the annual audited consolidated financial statements in the Company’s Annual Report on Form 10-K. | |||||||||

Compensation, Management Development and Succession (CMDS) | Erskine B. Bowles (Chair) C. Robert Kidder Donald T. Nicolaisen Hutham S. Olayan | • | Annually reviews and approves the corporate goals and objectives relevant to the compensation of the Chief Executive Officer and evaluates his performance in light of these goals and objectives. | 14 | ||||||

| • | Determines the compensation of executive officers and other officers and employees as appropriate. | |||||||||

| • | Administers the Company’s equity-based compensation plans. | |||||||||

| • | Oversees plans for management development and succession. | |||||||||

| • | Reviews and discusses the Compensation Discussion and Analysis with management and recommends to the Board its inclusion in the proxy statement. | |||||||||

| • | Reviews the Company’s incentive compensation arrangements to help ensure that such arrangements are consistent with the safety and soundness of the Company and do not encourage excessive risk-taking, and are otherwise consistent with applicable related regulatory rules and guidance. | |||||||||

| • | See “Compensation Governance” and “Consideration of Risk Matters in Determining Compensation” herein. | |||||||||

Nominating and Governance | Laura D. Tyson (Chair) Roy J. Bostock C. Robert Kidder James W. Owens | • | Identifies and recommends candidates for election to the Board. | 5 | ||||||

| • | Recommends committee structure and membership. | |||||||||

| • | Reviews annually the Company’s corporate governance policies. | |||||||||

| • | Oversees the annual evaluation of the Lead Director, Board and its committees. | |||||||||

| • | Reviews and approves related person transactions in accordance with the Company’s Related Person Transactions Policy. | |||||||||

Operations and Technology* | Donald T. Nicolaisen (Chair) Howard J. Davies James H. Hance, Jr. Ryosuke Tamokoshi (effective July 20, 2011) | • | Oversees the Company’s operations and technology strategy and significant investments in support of such strategy. | 2 | ||||||

| • | Oversees risk management and risk assessment guidelines and policies regarding operational risk. | |||||||||

Risk | Howard J. Davies (Chair) Roy J. Bostock James H. Hance, Jr. Maasaki Tanaka (effective May 18, 2011) | • | Oversees the Company’s risk governance structure. | 8 | ||||||

| • | Oversees risk management and risk assessment guidelines and policies regarding market, credit, liquidity and funding risk. | |||||||||

| • | Oversees risk tolerance, including risk tolerance levels and capital targets and limits. | |||||||||

| • | Oversees the Company’s capital, liquidity and funding. | |||||||||

| • | Oversees the performance of the Chief Risk Officer. |

* The Operations and Technology Committee was established in 2011 and held its inaugural meeting in July 2011.

11

member of the Company’s senior management and was awarded compensation in line with his position at Morgan Stanley and in comparison with market standards and that Mr. Bostock has no influence over the Asset Management business other than that possessed by any other Morgan Stanley non-employee director. The Board (other than Mr. Bostock) determined consistent with NYSE rules and based upon the facts and circumstances, that the relationship is immaterial to Mr. Bostock’s independence.13

In determining Mr. Sexton’s independence, the Board also considered the Company’s provision of medical insurance to Mr. Sexton (for which Mr. Sexton pays the full cost). The Board (other than Mr. Sexton) determined, consistent with NYSE rules and based upon the facts and circumstances, that the relationship is immaterial to Mr. Sexton’s independence.

Board Leadership Structure and Role in Risk Oversight.Oversight

Board Leadership Structure. The Board is responsible for reviewing the Board’sCompany’s leadership structure. TheAs set forth in the Corporate Governance Policies, the Board believes that the Company and its shareholders are best served by maintaining the flexibility to have any individual serve as Chairman of the Board based on what is in the best interests of the Company at a given point in time, rather than mandating a particular leadership structure. In making this decision, the Board considers,taking into consideration, among other things, thethings:

The composition of the Board, theBoard;

The role of the Company’s independent Lead Director, theDirector;

The Company’s strong corporate governance practices, thepractices;

The Chief Executive Officer’s (CEO) working relationship with the Board,Board; and the

The challenges specific to the Company. Historically,

After a two-year transition period, Mr. Gorman assumed the positionsadditional role of Chief Executive Officer and Chairman were held by the same individual. As a result of Mr. Mack’s discussion with the Board about stepping down as Chief Executive Officer and as part of its ongoing review of the Board’s leadership structure and succession planning process, the Board in September 2009 determined that the positions of the Chief Executive Officer and Chairman should be held by two separate individuals. The Board elected John J. Mack, the Company’s former Chief Executive Officer, as Chairman of the Board, and James P. Gorman as the Company’s Chief Executive Officer, effective January 1, 2010.2012, replacing John J. Mack as Chairman upon his retirement from the Board. The Board has determined that the appointment of a strong independent Lead Director (as described below), together with a combined CEO and Chairman, serves the best interests of the Company and its shareholders. By serving in both positions, the CEO and Chairman is able to draw on his detailed knowledge of the Company to provide the Board, in coordination with the Lead Director, leadership in focusing its discussions and review of the Company’s strategy. In addition, a combined role of CEO and Chairman ensures that the Company presents its message and strategy to shareholders, employees and customers with a unified voice. The Board believes that it is in the best interest of the Company and its shareholders for Mr. Gorman to serve as Chairman and CEO at this time, considering the strong role of our independent Lead Director and other corporate governance practices providing independent oversight of management as set forth below.

In addition, the Company’sLead Director. The Corporate Governance Policies provide for an independent and active Lead Director that is appointed, and reviewed annually, by the independent directors with clearly defined leadership authority and responsibilities. Our Lead Director, C. Robert Kidder, was appointed by our other independent directors in 2006 and has responsibilities including: (i) presiding

Presiding at all meetings of the Board at which the Chairman is not present; (ii) having

Having the authority to call, and lead, sessions composed only of non-management directors or independent directors; (iii) advising

Serving as liaison between the Chairman and the independent directors;

Advising the Chairman of the Board’s informational needs; (iv) approving

Approving the types and forms of information sent to the Board;

Approving Board meeting agendas and the schedule of Board meetings and requesting, if necessary, the inclusion of additional agenda items; and (v) making

Making himself available, if requested by major shareholders, for consultation and direct communication.

Independent Oversight of Management. The Company’s Corporate Governancecorporate governance practices and policies ensure substantial independent oversight of management. For instance:

The Board has a substantial majority of independent and non-management directors. Ten out of the thirteen13 director nominees are independent as defined by the NYSE listing standards and the Company’s more stringent Corporate Governance Policies and eleven12 out of the thirteen13 director nominees are non-management directors. All of the Company’s directors are elected annually.

14

The Board’s key standing committees are composed solely of non-management directors. The Audit Committee, the Compensation, Management Development and Succession Committee, and the Nominating and Governance Committee are each composed solely of independent directors. The Operations and Technology Committee and Risk Committee is comprisedconsist of a substantial majority of independent directors and includesinclude only non-management directors. The committees provide independent oversight of management.

The Board’s non-management directors meet regularly in executive session. At each regularly scheduled Board meeting, theThe non-management directors meet regularly in an executive session without Messrs. Gorman or Mackmanagement present and, consistent with the NYSE listing standards, at least annually, the independent directors meet in executive session. These sessions are chaired by the Lead Director.

12

Board Role in Risk Oversight. The Board has oversight for the Company’s enterprise risk management framework and is responsible for helping to ensure that the Company’s risks are managed in a sound manner. Historically,The committees discussed below assist the Board had authorized the Audit Committee, which is comprised solely of independent directors, to overseein its risk management. Effective January 1, 2010, theoversight. The Board established another standing committee, the Risk Committee, which is comprised solely of non-management directors, to assist the Board in the oversight of (i) theof:

The Company’s risk governance structure, (ii) thestructure;

The Company’s risk management and risk assessment guidelines and policies regarding market, credit and liquidity and funding risk, (iii) therisk;

The Company’s risk tolerance, including risk tolerance levels and capital targets and limits,limits;

The Company’s capital, liquidity and (iv) thefunding; and

The performance of the Chief Risk Officer.

The Audit Committee retains responsibility for oversight of certain aspects of risk management, including review of the major operational, franchise, reputational, legal and compliance risk exposures of the Company and the steps management has taken to monitor and control such exposure, as well as, in coordination with the Risk Committee and the Operations and Technology Committee, guidelines and policies that govern the process for risk assessment and risk management. The RiskOperations and Technology Committee has responsibility for oversight of operational risk. The Audit Committee, Operations and Technology Committee, Risk Committee and Chief Risk Officer report to the entire Board on a regular basis.

As discussed herein under “Consideration“Executive Compensation – Consideration of Risk Matters in Determining Compensation,” the Compensation, Management Development and Succession (CMDS) Committee works with the Chief Risk Officer and its independent compensation consultant to evaluate whether the Company’s compensation arrangements are consistent with the safety and soundness of the Company or encourage unnecessary or excessive risk-taking and whether any risks arising from the Company’s compensation arrangements are reasonably likely to have a material adverse effect on the Company.

The Board has also authorized the Firm Risk Committee, (FRC), a management committee appointed and chaired by the Chief Executive OfficerCEO that includes the most senior officers of the Company, including the Chief Risk Officer, Chief Legal Officer and Chief Financial Officer, to oversee the Company’s global risk management structure. The FRC’sFirm Risk Committee’s responsibilities include oversight of the Company’s risk management principles, procedures and limits and the monitoring of capital levels and material market, credit, liquidity and funding, legal, compliance, operational, franchise and regulatory risk matters, and other risks, as appropriate, and the steps management has taken to monitor and manage such risks. The Company’s risk management is further discussed in Part I,II, Item 7A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 (20092011 (2011 Form 10-K).

* * * * *

Assessment of Leadership Structure and Risk Oversight. The Board has determined that its leadership structure is appropriate for the Company. Mr. Mack’s priorGorman’s role as Chief Executive Officer,CEO, his existing relationship with the Board, his understanding of Morgan Stanley’s businesses, and his professional experience and leadership skills uniquely position him to serve as Chairman and CEO, while the Company’s Lead Director, Mr. Kidder, has proven

15

effective at enhancing the overall independent functioning of the Board. The Board believes that the combination of the Chairman and CEO, the Lead Director and the Chairmen of the Audit, CMDS, Risk and Risk CommitteesOperations and Technology committees provide the appropriate leadership to help ensure effective risk oversight by the Board.

13

Board Meetings and Committees.Director Compensation Our Board met 26 times during the December 2008 transition period and 2009. Each director attended at least 75% of the total number of meetings of the Board and committees on which the director served that were held during the December 2008 transition period and 2009 while the director was a member. The Board’s standing committees include the following:

The following table contains information with respect to the annual compensation (including deferred compensation) of our non-employee directors earned during 2011 with respect to his or her Board service. |

|

| ||||||

|

|

| ||||||

|

|

| ||||||

|

|

|

14

*In addition to Board and committee meetings, our directors also discharge their duties through, among other things, informal group communications and discussions with the Chairman, CEO, members of senior management and others as appropriate regarding matters of interest.

| Director(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3)(4) | Option Awards ($)(4) | Change in Pension Value and Nonqualified Deferred Compensation Earnings | All Other Compensation ($) | Total ($) | ||||||||||||||||||

Roy J. Bostock | 95,000 | 250,000 | — | — | — | 345,000 | ||||||||||||||||||

Erskine B. Bowles | 95,000 | 250,000 | — | — | — | 345,000 | ||||||||||||||||||

Howard J. Davies | 112,917 | 250,000 | — | — | — | 362,917 | ||||||||||||||||||

James H. Hance, Jr. | 102,917 | 250,000 | — | — | — | 352,917 | ||||||||||||||||||

C. Robert Kidder | 125,000 | 250,000 | — | — | — | 375,000 | ||||||||||||||||||

Donald T. Nicolaisen | 117,917 | 250,000 | — | — | — | 367,917 | ||||||||||||||||||

Hutham S. Olayan | 85,000 | 250,000 | — | — | — | 335,000 | ||||||||||||||||||

James W. Owens | 77,917 | 333,333 | — | — | — | 411,250 | ||||||||||||||||||

O. Griffith Sexton(5) | 87,083 | 250,000 | — | — | — | 337,083 | ||||||||||||||||||

Laura D. Tyson | 95,000 | 250,000 | — | — | — | 345,000 | ||||||||||||||||||

(1) Messrs. Tamakoshi and Tanaka and employee directors received no compensation during 2011 for Board service. No compensation information is included in the table for Mr. Hance joinedMack, the Audit Committee, effective January 1, 2010.Company’s 2011 Chairman of the Board, pursuant to SEC rules, because in 2011 he was an executive officer of the Company, other than a named executive officer, who did not receive any additional compensation for his services as a director.

(2) Mr. Bowles was appointed as chairRepresents the portion of the CMDS Committee to replaceannual Board and Board committee retainers that was earned or deferred at the director’s election during 2011. Mr. Kidder, effectiveOwens joined the Board of Directors on January 1, 2010. Mr. Kidder remains2011 and, accordingly, his Board and committee retainers were prorated for service as described below. Cash retainers for service on the CMDS Committee.Board and a Board committee are paid semi-annually in arrears for the period beginning at the 2011 annual meeting of shareholders and concluding at the 2012 annual meeting of shareholders (the 2011 service period). Amounts in the table represent (i) cash retainers earned for a portion of the 2010 service period (January 1, 2011 to May 18, 2011, the date of the 2011 annual meeting of shareholders) paid or deferred on May 18, 2011, (ii) cash retainers earned for a portion of the 2011 service period (May 19, 2011 to November 18, 2011, the six-month anniversary of the 2011 annual meeting of shareholders) paid or deferred on November 18, 2011, and (iii) cash retainers earned for a portion of the 2011 service period (November 19, 2011 to December 31, 2011) payable on May 15, 2012, the date of the 2012 annual meeting of shareholders (or, if earlier, upon termination from the Board).

The annual Board retainer for the 2011 service period for each director is $75,000. In addition, the Lead Director, each of the Board committee chairs and each Board committee member receives additional annual retainers for the 2011 service period, as set forth in the following table. Retainers are prorated when a director joins the Board or a Board committee at any time other than at the annual meeting of shareholders (provided that no retainers are paid if the director is elected to the Board less than 60 days prior to the annual meeting). Directors do not receive meeting fees.

16

| Retainer | ||||

Lead Director (Mr. Kidder) | $ | 30,000 | ||

| ||||

Committee Chair | ||||

Audit Committee (Mr. Nicolaisen)* | $ | 25,000 | ||

Compensation, Management Development and Succession Committee (Mr. Bowles) | $ | 20,000 | ||

Nominating and Governance Committee (Dr. Tyson) | $ | 20,000 | ||

Operations and Technology Committee (Mr. Nicolaisen)* | $ | 10,000 | ||

Risk Committee (Mr. Davies) | $ | 20,000 | ||

Committee Members | ||||

Audit Committee (Messrs. Davies, Hance and Sexton)* | $ | 10,000 | ||

Compensation, Management Development and Succession Committee (Messrs. Kidder and Nicolaisen and Ms. Olayan) | $ | 10,000 | ||

Nominating and Governance Committee (Messrs. Bostock, Kidder and Owens) | $ | 10,000 | ||

Operations and Technology Committee (Messrs. Davies and Hance)* | $ | 10,000 | ||

Risk Committee (Messrs. Bostock and Hance) | $ | 10,000 | ||

| * | Effective as of May 17, 2011, Chair and member fees for the Audit Committee were each reduced by $5,000 and Chair and member fees of $10,000 were instituted for the Operations and Technology Committee. |

Directors can elect to receive all or a portion of their retainers for the 2011 service period on a current basis in cash or shares of common stock or on a deferred basis in stock units under the Directors’ Equity Capital Accumulation Plan (DECAP). Directors receive dividend equivalents on stock units that are paid in the form of additional stock units. Messrs. Bostock, Davies, Hance, Kidder, Nicolaisen, Owens and Dr. Tyson received their retainers for the 2011 service period in cash on a current basis. Messrs. Bowles and Sexton and Ms. Olayan deferred their retainers for the 2011 service period into stock units (Elective Units). Elective Units are not subject to vesting or cancellation.

On May 18, 2011, the date of the 2011 annual meeting of shareholders, each of Messrs. Bowles and Sexton and Ms. Olayan received a number of Elective Units in lieu of the remaining 50% of his or her cash retainers earned for the 2010 service period that began on May 18, 2010, the date of the 2010 annual meeting of shareholders, and payable on such date determined by dividing the dollar value of such cash retainers by $24.3936, the volume-weighted average price of the common stock on the grant date.

On November 18, 2011, the six-month anniversary of the date of the 2011 annual meeting of shareholders, each of Messrs. Bowles and Sexton and Ms. Olayan received a number of Elective Units in lieu of the first 50% of his or her cash retainers earned for the 2011 service period and payable on such date determined by dividing the dollar value of such cash retainers by $14.2034, the volume-weighted average price of the common stock on the grant date.

(3) Ms. Olayan concluded herRepresents the aggregate grant date fair value of the annual stock unit award for the 2011 service period and, with respect to Mr. Owens, a prorated initial stock unit award, granted during 2011 determined in accordance with the applicable accounting guidance for equity-based awards. The aggregate grant date fair value of annual stock units granted on May 18, 2011 for the 2011 service period is based on $24.3936, the volume-weighted average price of the common stock on the Nominatinggrant date. The aggregate grant date fair value of the initial stock units granted to Mr. Owens on February 1, 2011 is based on $29.8294, the volume-weighted average price of the common stock on the grant date. For further information on the valuation of these stock units, see notes 2 and Governance Committee20 to the consolidated financial statements included in the 2011 Form 10-K.

Under DECAP, directors receive an equity award upon initial election to the Board (provided that they are elected to the Board no less than 60 days prior to the annual meeting and joinedare not initially elected at the CMDS Committee, effective January 1, 2010.annual meeting) and an equity award annually thereafter on the date of the annual meeting of shareholders. The dollar value of the initial equity award is $250,000, prorated for service until the annual meeting. The dollar value of

17

the annual equity award is $250,000. Initial and annual equity awards are granted in the form of 50% stock units that do not become payable until the director retires from the Board (Career Units) and 50% in the form of stock units payable on the first anniversary of grant (Current Units). Initial equity awards are fully vested upon grant. Annual equity awards are subject to monthly vesting until the one-year anniversary of the grant date. On May 18, 2011, the date of the 2011 annual meeting of shareholders, directors received their annual equity awards for the 2011 service period in the form of 10,248.59 stock units (determined by dividing $250,000 by $24.3936, and allocating 50% to Career Units and 50% to Current Units). With respect to Career Units, directors may elect to extend deferral beyond retirement from the Board, subject to specified limitations. With respect to Current Units, directors may choose to defer receipt of the shares underlying Current Units beyond the anniversary of grant and may choose the form of distribution (lump sum or installment payments).

(4) Mr. Kidder will joinThe following table sets forth the Nominatingaggregate number of shares underlying DECAP stock units and Governance Committeestock options outstanding at December 31, 2011. The number of units set forth in the following table is rounded to replace Mr. Phillips, effective May 18, 2010.the nearest whole number of units.

| Name | Stock Units (#) | Stock Options (#)(a) | ||||||||

Roy J. Bostock | 35,904 | — | ||||||||

Erskine B. Bowles | 67,657 | — | ||||||||

Howard J. Davies | 42,173 | 7,049 | ||||||||

James H. Hance, Jr. | 18,732 | — | ||||||||

C. Robert Kidder | 50,926 | 33,273 | ||||||||

Donald T. Nicolaisen | 45,774 | — | ||||||||

Hutham S. Olayan | 60,979 | — | ||||||||

James W. Owens | 13,126 | — | ||||||||

O. Griffith Sexton | 60,009 | — | ||||||||

Laura D. Tyson | 25,459 | 25,847 | ||||||||

| (a) | Directors were awarded stock options annually under DECAP until February 8, 2005, at which point stock option awards were discontinued. As of December 31, 2011, the outstanding stock options had no intrinsic value because the exercise price of each stock option was greater than $15.13, the closing price of the Company’s common stock on December 30, 2011. |

(5)Mr. Sexton was an advisory director of the Company from May 1995 until September 2008 and was a full-time Company employee prior to becoming an advisory director. The Board establishedCompany provides Mr. Sexton with access to medical insurance, for which he pays the Risk Committee effective January 1, 2010.full cost.

Related Person Transactions Policy

Our Board has adopted a written charter for each ofRelated Person Transactions Policy (Policy) requiring the Audit Committee, CMDS Committee, Nominating and Governance Committee and Risk Committee setting forth the roles and responsibilities of each committee. The Audit Committee has adopted a written charter for its subcommittee, the Internal Audit Subcommittee, which assists the Audit Committee in the oversight of the Company’s internal audit department. The charters are available at our corporate governance website at www.morganstanley.com/about/company/governance/index.html. The reports of the Audit Committee and the CMDS Committee appear herein.

Non-Management Director Meetings. The Company’s Corporate Governance Policies provide that non-management directors meet in executive sessions and that the Lead Director will preside over these executive sessions. If any non-management directors are not independent, then the independent directors will meet in executive session at least once annually and the Lead Director will preside over these executive sessions.

Director Attendance at Annual Meetings. The Company’s Corporate Governance Policies state that directors are expected to attend annual meetings of shareholders. All of the current directors who were on the Board of Directors at the time attended the 2009 annual meeting of shareholders other than Mr. Phillips.

Shareholder Nominations for Director Candidates. The Nominating and Governance Committee will consider director candidates recommended by shareholders and evaluates such candidates in the same manner as other candidates. The procedures to submit recommendations are described in the Policy Regarding Director Candidates Recommended by Shareholders, available at our corporate governance webpage at www.morganstanley.com/about/company/governance/index.html.